The rise of digital technology has drastically changed the mode of payment. People rely on debit cards, Visa/MasterCard cards, or mobile phone applications for quick and secure payment options. In the digital age, users are introduced to another digital mode of payment known as NFC. The technology became popular in the year, 2004, when famous brands, Nokia and Sony worked in partnership to form an NFC forum. In the same year, contactless payment was launched in the USA. In 2008, Visa, MasterCard, and American Express created contactless credit cards. As technology progressed, mobile app development created digital wallet solutions comprising Google Wallet and Android Pay NFC-enabled cards to initiate contactless payment through smartphones.

Today, NFC-enabled payment systems are well-recognized globally. According to Insider Intelligence, 48.2% of smartphone users in the year 2023-24 will execute their mobile payments with contactless cards. Global Payments Report, 2021 estimates that by 2024, digital wallet payment volume will reach 40.5%.

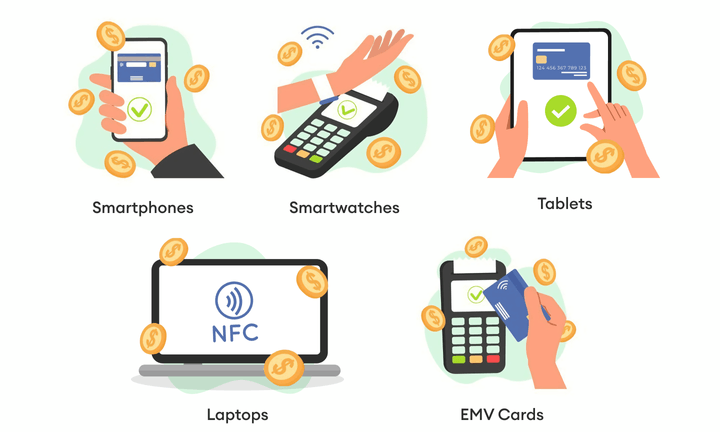

The process of NFC payment allows consumers to make payments with smartphones, Android devices, iPhones, laptops, tablets, and smartwatches. People no longer require credit or debit cards to make online payments. As the users tap their NFC-enabled smartphones, they can make fast and secure payments using contactless digital payment options.

Moreover, embracing contactless helps companies to make quick, effortless, and safe payments. Both small and large enterprises who are involved with online business are using this contactless payment processing option to meet day-to-day transactions. For instance, a range of businesses, including retailers, restaurants and online stores accept NFC payments. Businesses have streamlined their payment process by employing this contactless payment solution. Consequently, it helps reduce the risk of handling cash, generate high revenue, and monetize their NFC payment infrastructure. Thus, NFC payments have offered convenient options of payment for businesses to improve international transactions, and expand their customer base worldwide.

Mastering Contactless Payments: Fast, Hassle-Free Solutions for All!

NFC technology has a seamless payment system that connects two devices to communicate when they are nearby. The contactless payment system introduced in the early 2000s employed a specific RFID frequency (13.56MHz) for close-range communications. As NFC payment has expediently become popular and convenient for consumers and businesses, many companies use NFC identification cards to make contactless payments. It does not require any physical contact between a reader and a payment device. The users just need to hold up their mobile devices to pay the required amount. Both the reader and payment device must contain chips to facilitate the data exchange. The data exchange includes providing encrypted information such as face ID, fingerprint, or a passcode. Moreover, the users are required to provide authorization from the mobile device. Once the information is validated, the transaction information is transmitted into the business bank account automatically. The users insert a randomly generated one-time code that secures the transaction. Thus, biometric and multi-factor authentication is done, and the users can proceed with the transaction process.

Companies dealing with NFC mobile payments are required to follow a simple process. They have to choose a payment-processing company that offers NFC-enabled technology. Once connected with merchant services, the business should set up their merchant account with its bank or the processing company they are collaborating with. The next step involves installing an NFC reader-based POS solution that helps companies accept NFC payments. An NFC reader will automatically proceed with transactions into the company’s business bank account on the same day. For those exploring the world of digital assets, incorporating NFT development service into their business model can open up new and innovative possibilities within the evolving landscape of blockchain technology.

Different types of businesses accept NFC payments. They comprise retailers who manage online clothing stores, outfit dealers, and home goods stores. Street vendors, restaurants, and food-service businesses are also involved with multiple payments. Fitness and recreation services and other small and big enterprises operate their cash business using NFC payment mode.

NFC payment can be transmitted through numerous mobile devices. NFC mobile application development has created innovative applications that use encrypted and tokenized technologies. If you are using smartphones to make NFC payments, you are required to integrate various wallet apps into Android, iPhone, and other mobile devices. Digital Wallet apps including Apple Pay, Samsung Pay, and Google Pay have NFC features. Once users have access to these apps on their devices, they just need to grab the device within range and make payment instantly. NFC technology reduces queue time, enabling users to make convenient and quick digital payments. Customers who prefer online payment systems also use wearables including smartwatches, Apple Watch, and Google Wear OS to make NFC payments.

Tablets and laptops having in-built NFC features allow consumers to make digital payments. Laptops and other devices are connected to an NFC-enabled card that enables companies to receive quick instant payments. To further streamline the payment process, many companies use EMV Cards: Today, most online users have credit and debit cards with EMV chip that supports NFC. Contactless payment solutions offer vast possibilities to companies to make online payments. The payment technology is generally considered safe and convenient like mobile credit card processing. Hence, they benefit both businesses and customers with seamless payment solutions.

Unlock the simplicity, convenience, speed, and security of contactless payments!

Unlock the world of contactless payments, where simplicity, convenience, speed, and security converge. Say goodbye to fumbling for cash or swiping cards – just tap, scan, or wave your way to effortless transactions. Whether it’s with NFC, QR codes, or other emerging technologies, the future of payments is at your fingertips, making your financial interactions seamless and safe.

Benefits for Consumers

-

Convenient Payment Options

Whether consumers are using credit and debit card payments or getting involved with online payment, they always expect to have secure and convenient transactions. If you have to make multiple payments for different purposes, you must opt for the NFC payment system. While choosing an online transaction mode of payment, this contactless payment solution appears to be a more reliable, fast, simple, and appropriate payment option for consumers. The users have to install an NFC POS reader in their mobile device or wearables to make payments. There is no hassle of payment, just consumers are required to hold up their phones or their NFC cards to make instant payment. Unlike other transactions, where consumers have to wait for hours to get payment approved, NFC mobile payments follow an easy, intuitive, and quick payment process. For businesses looking to capitalize on the trend of wearables, integrating wearable app development services into their strategy can enhance the overall user experience and provide a seamless payment solution through wearable devices.

-

The Efficiency of NFC Payments

Customers who have to make consistent online payments look for a fast and efficient payment system. Using mobile wallets, consumers can process huge amounts to either buy groceries, online shopping, pay tuition fees, or travel by public transportation. NFC mobile payments through mobile apps, including UPI Payment App Development, are effective. Consumers are required to get connected to the payment processor. Ensure that the mobile device or gadget is equipped with radio frequency identification (RFID). Furthermore, it should be properly linked with the service provider’s account to transfer payment swiftly. NFC payments can be made via contactless cards and mobile wallets. Hence, NFC payment options are user-friendly and accessible to consumers.

-

Enable Seamless Secure Payments

The increasing trend of using digital payment solutions has encouraged many users to integrate their devices with digital payment that offers a secure and seamless payment experience. By adding contactless card or mobile wallet apps such as Apple Pay or Google Pay to their smartphone or wearable device, consumers can make rapid contactless payments. Safe transmission is made within 24 hours. If the transaction is small, it transfers the amount instantly. In case, big payments are made, it transferred to the business account the following day.

-

Contactless Travel Payment

NFC payment solutions have facilitated customers to have easy and contactless ticketing and payment options. A traveler can buy e-tickets using any mobile device or wearable or NFC-enabled cards. Consumers are required to tap the information tags inserted in the app. They can easily download the tickets and read the required information. Contactless payment appears to be durable and feasible for frequent travelers as they can pay their transit expenses instantly. If you are making a short-distance bus journey, you can smoothly tap your card or mobile wallet on your mobile to make a payment. Hence, NFC payment offers convenient and safe payment options to visitors.

Benefits for Businesses

-

Dynamic and progressive contactless payment option

The businesses that have embraced NFC payments indicate that they are forward-thinking companies that offer fast, resourceful, and convenient payment options for customers. The wireless financial transaction option allows businesses to make transactions through chip-enabled bank cards and digital wallet apps. NFC payments are vibrant and secure as users are not required to share billing information directly with the seller. Before payment, users are provided with a one-time transaction code that keeps transmitted data secured. The dynamic authentication technology generates a new code each time a chip card is used for payment. It helps prevent data breaches and hacking of business accounts.

-

NFC supports businesses in improving the consumer’s in-store experience

Companies can use NFC apps for asset tracking. The innovative payment option allows companies to know when the consumers leave the storage area, whether they have made online payments through NFC cards or mobile wallets. The NFC app secures all consumer data including the name, particulars, and personal contact details. Moreover, the online store also expounds the amount paid to make online purchases. To check the transparency and security of the asset and payment, the users can log in again to their accounts to check online receipts and balances. Having attached NFC tags at storage facilities allows companies to regularly check consumers’ status each time they make purchases. NFC improves customer service and develops business process control.

-

Cost-effective payment method

Offering tangible benefits to businesses, NFC lessens payment processing time. The users can make NFC payments using different devices and methods. NFC cards and cards and mobile wallets, streamline the payment process. Consumers can easily sign up for the account and make quick payments. Consequently, they gain faster checkout experiences. An economical contactless payment system minimizes cash handling while reducing the need to carry physical cards.

-

Security protections

NFC offers a high level of data encryption, connection, and data exchange. NFC has a highly efficient security system that makes data exchange secure. Businesses can protect data and make secure payments through tokenization of private and personally identifying data. The smartphone device allows users to provide authentication passwords and biometric security. The additional security feature prevents fraud filters and secures business transactions.

-

NFC technologies work without Wi-Fi or 3G

It is a significant advantage for small and medium businesses that lack internet facilities or have weak internet signals. Sometimes, users have to make urgent payments, and exchanging data without the internet makes online payment a hassle. Therefore, many small businesses do not invest in installing digital technologies, rather they use contactless payment options. For instance, small shops use POS terminals having built-in NFC functions as they mostly lack Wi-Fi facilities. They execute their businesses by deploying wireless technology that connects two NFC devices. Many hotels and restaurants also provide NFC payment options in case users have no Wi-Fi access or their 3G limit expires. NFC technology has grown versatile; it is open, steady, and accessible for all users. NFC technology is helpful for multiple business purposes. Either the company buys NFC tags or stickers and configure them with the consumer’s account and service providers. The other payment option is using appropriate NFC mobile wallet apps that help process quick and smart payments.

The Global Trends and Future Prospects of NFC Payments:

The environment of transactions is changing as a result of global trends and NFC payments’ potential. These technological developments have simplified payments, making contactless transactions more common and practical. The world is currently experiencing a change brought on by NFC technology, with the future of payments being defined by speed, security, and frictionless interactions. NFC payments are expected to become increasingly important as the world of digital banking develops.

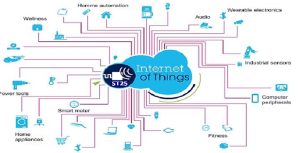

1. The Role of NFC in the Internet of Things (IoT)

Approximately all modern smartphones have built-in NFC chips and Mobile wallet apps that ensure secure and easy payment options. NFC also facilitates users with quick payment if they lack internet access. For instance, mobile devices and wearables have built-in NFC tags. Whenever a user gets connected to a new device, they can use an NFC tag to automatically configure the device and make payments.

NFC increases IoT scalability as NFC can be feasibly used in areas with restricted security access or lack Wi-Fi. NFC enables people to use their smartphones, wristbands, and other gadgets to make contactless payments. NFC connects two separate IoT devices with minimal configuration. The system just requires wireless technology as the users have to keep the device close to the other device to process transactions. Moreover, joining the two devices through NFC provides easy network access and data sharing. The users no longer need to make data entries or require an internet connection, they just need to tap their NFC-enabled devices to make online payments. Consequently, NFC offers data security through different devices and networks.

2. NFC Wearables and other Innovations Used for Payment

The contactless payment option benefits customers by making payments through different methods. The most popular procedure for making digital payments is using smartwatches, wristwatches, bracelets, rings, and other electronic devices. Before using the wearable device for payment, the users are required to associate the device with a payment method including a contactless card, a bank account, or a smartphone app. Once the device is connected, the users should wear it and install point-of-sale (POS) hardware to manage NFC payments. Wearable payment devices are incorporated with NFC technology. Wearable users can make payments without taking out their phone, card, or wallet. Thus, NFC facilitates both consumers and businesses in making convenient and accessible payment choices.

3. Future Trends and The Global Landscape of NFC Payments

-

Biometric payments

Biometric technology is one of the rising trends that offer seamless and secure contactless payment options to users. Customers who use biometric transactions do not require authentication methods like PINs and passwords. Instead, biometric payments follow the identification process comprising fingerprints, face, voice, and signatures to authenticate transactions. Moreover, consumers do not need to carry physical cards or cash to make quick transactions.

-

QR code payments

Another emerging digital payment option is QR codes. The users who employ this contactless payment do not need to keep credit / Master cards or cash to make transactions. The payment process is easy and convenient for the users. They need a smartphone camera to scan the code and make authentic and secure transactions. Since contactless payment has increasingly been used by consumers globally, QR code payments offer increased security by encrypting payment information and data. Being cost-effective, the users do not require any software to be installed. Therefore, this mode of payment is extensively used by small businesses to make secure and fast transactions.

-

Digital wallet

An advanced and convenient payment solution allows consumers to store multiple payment methods in one place. Consumers store their credit and debit cards, loyalty cards, and gift cards in one place. Moreover, users are ensured that payment information in their digital wallet is secured. Consumer data is encrypted and tokenized which decreases the risk of fraud and also protects data from unauthorized access.

Conclusion

Contactless payments have become popular and convenient for consumers and businesses as they offer a faster, safer, and easier way of payment. In the digital era, more people use numerous devices including smartphones, smartwatches, and other devices to pay for online transactions. The contactless payment option offers convenience, speed, and security of payment. Instead, of carrying cash or cards, the users have to scan their devices and transmit payment information. The users have to simply hold their smartphone and pay instantly. An exclusive feature of NFC mobile payments is the two-way encryption that ensures higher security such as face ID, fingerprint, or a passcode. The card information and a randomly generated one-time use code are inserted to ensure data transfer security and provide a seamless and consistent payment experience to users across different channels and platforms. NFC technologies provide more options and benefits for both consumers and businesses. It includes authentication, loyalty, rewards, and data analytics. Technology innovation in NFC has revolutionized the payment industry, ensuring the security and privacy of mobile and contactless payments.